There’s an old saying in the car business that you can’t sell a car you don’t have in hand.

The truth of this statement proved especially true for dealers in the aftermath of the COVID-19 pandemic. Through much of 2020 and 2021, the chief problem dealers faced wasn’t the perennial challenge of selling cars. No, acquiring inventory effectively served as the primary operational challenge for dealerships across the country.

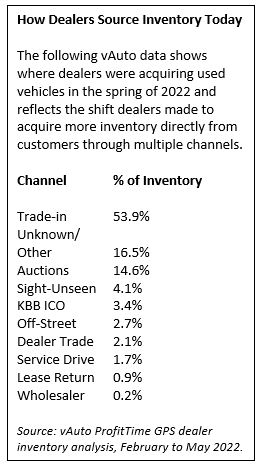

In this timeframe, dealers made what amounted to a seismic shift in the way they acquired inventory. In prior years, the used vehicle departments at dealerships relied mostly on auctions, trade-ins and off-lease customers to get the inventory they needed to meet their monthly retail sales goals. National Automobile Dealers Association (NADA) data from 2019 shows that nearly two-thirds of the inventory dealers acquired came from trade-ins that resulted from new and used vehicle sales. Almost 30 percent of the inventory came from auctions, with the balance coming from off-street, wholesalers and “other” sourcing channels.

Today, the means and mix of used vehicle sourcing at dealerships looks decidedly different. While trade-ins remain a primary sourcing pipeline for dealers (accounting for roughly 54 percent of used vehicles), auctions now provide less than 15 percent, according to inventory sourcing data from vAuto’s ProfitTime GPS dealers.

The shift begs a question: Where are the other cars coming from? The answer reflects the “buy from anywhere and everywhere” strategy that many dealers adopted in the past two years as high demand, high values and limited supplies of used vehicles pushed dealers to source vehicles differently than they had in the past. More dealers adopted strategies to acquire more inventory directly from customers through we’ll-buy-your-car and similar programs, as well as through other dealers. (The chart at right shows inventory sourcing data from vAuto dealers during the spring of 2022.)

The Rise of Multi-Channel Used Vehicle Sourcing

In some ways, the shift in used vehicle sourcing for dealers wasn’t entirely new. Large retailers like CarMax and Carvana built their business models in part on the idea of sourcing more vehicles directly from customers. Such efforts didn’t go unnoticed by franchise and independent dealers.

Some franchise and independent dealers, particularly those who operated in close proximity to a larger, standalone competitor like CarMax of Carvana, adopted similar direct-from-customer purchases. But as a whole, the shift to a multi-channel used vehicle sourcing wasn’t a critical business need. Dealers had a reliable incoming supply of trade-ins from their new and used vehicle departments, as well as a stable pool of off-lease customers. When these channels didn’t supply the retail units dealers needed, they could turn to auctions where they found plentiful supplies of late-model vehicles being sold by finance companies, rental car companies and a host of wholesale sellers (including CarMax and Carvana). Dealers paid more to purchase auction vehicles, but these higher-cost purchases were off-set by the more cost-favorable inventory they sourced from more traditional channels.

You could make a good case that the months following the COVID-19 pandemic put dealer efforts to diversify their used vehicle sourcing went into overdrive. At the time and almost ever since, historically high retail demand and limited used vehicle supplies, pushed the costs of some auction vehicles above their current retail prices. At the same time, the numbers of trade-ins dealers received diminished, particularly those they acquired with regularity from new vehicle sales, which have suffered due to low levels of new vehicle inventory.

This reality forced dealers to revisit the age-old saying, “You can’t sell a car you don’t have in hand” and do something that would enable them to consistently acquire vehicles that offered a high probability of profit-making potential, rather than bringing in vehicles that cost more than prevailing retail asking prices.

But as dealers entered the age of multi-channel used vehicle sourcing in earnest, they found themselves facing a new, two-pronged business challenge: How to get their appraisers and buyers more comfortable with acquiring vehicles from unfamiliar sourcing channels, and how to ensure a greater level of consistency in how much they paid to acquire vehicles to ensure a satisfactory profit-making outcome for the dealership with every used vehicle acquisition.

Vehicle Inventory Metrics to Optimize Multi-Channel Sourcing

Just as dealers began to proactively adopt multi-channel “buy anywhere and everywhere” used vehicle sourcing strategies, vAuto founder Dale Pollak recognized that the shift would create operational challenges for dealers. “Dealers are sourcing more inventory from unfamiliar channels, and there isn’t an easy way for dealers to manage the success of their acquisition efforts in individual channels to optimize the outcomes,” Pollak says.

The realization led to the development of the ProfitTime Global Acquisition System. The system gives dealers a dashboard view of vehicle inventory metrics that can help dealers ensure the appraisers and buyers consistently acquire vehicles in accord with a dealership’s strategic objectives.

“Before the pandemic, if you asked a dealer how they managed the performance of their appraisers and buyers, many would point to their Look to Book and Cost to Market metrics for their inventories,” Pollak says. “A few might also know the Look to Book and Cost to Market metrics for individual appraisers or buyers. Either way, we typically saw double-digit differences in how appraisers and buyers purchased cars—a problem that has grown exponentially as dealers adopt multi-channel used vehicle sourcing channels.”

To address the problem, Pollak and vAuto developers met with dealers to determine the specific metrics that could guide dealers and their teams to more consistent and favorable outcomes as they sourced inventory from disparate channels. The goal was to give dealers a bird’s-eye view of the number and type of vehicles sourced in each channel, as well as indicators to show how “right” the vehicles have been acquired compared to the dealership’s overall vehicle acquisition strategy.

Here’s a quick overview of the source channel-specific metrics vAuto dealers are using to help them optimize their used vehicle sourcing in each channel:

Volume: As dealers adopt multi-channel used vehicle sourcing strategies, it’s important for them to know the channels that produce the most cars, and those that might offer opportunity to drive additional inventory volume.

Days to Sell: Every used vehicle’s window for optimal investment return is different. The differences owe to how right you acquire a car, its appeal/sales volume in a market and its retail price position. Hence, it’s important for dealers to track the days to sell by sourcing channel to understand how vehicles perform once they’re acquired.

Model Year: Analysts expect the current shortage of late-model inventory to persist for years, which is spurring consumer demand/interest in older-age inventory that many franchise dealers are unaccustomed to selling. By tracking the average model year in each sourcing channel, dealers can readily identify that tend to supply near-new or older inventory.

Odometer: Vehicles with lower mileage have higher retail sales potential. Dealers can use this metric to know the average mileage of vehicles acquired in each channel.

Investment Score: vAuto’s ProfitTime GPS system uses data science to produce an investment score that indicates each vehicle’s net profit or return-on-investment potential at the point of acquisition. With this metric, dealers can see the channels that produce the vehicles with highest/lowest investment values, coach their teams for better outcomes and track how the values change over time.

Dealers who use the new vehicle inventory metrics to guide their sourcing efforts are finding better outcomes—including more consistency among appraisers and buyers, and a clearer understanding of the channels where they are most likely to source specific vehicles. “The Global Acquisition system inside ProfitTime GPS has made me a more consistently disciplined buyer,” says James Mason, used vehicle director at Steven Toyota, Harrisonburg, VA.

Setting the Stage for Continued Used Vehicle Sourcing Success

Dealers who have adopted a multi-channel strategy for used vehicle sourcing say there’s no going back to the old ways of relying on auction vehicles and trade-ins to get the inventory they need.

In particular, vAuto’s Dale Pollak believes service drive acquisitions hold the most largely untapped potential for dealers as they face a market where late-model vehicles are in short supply and wholesale values remain elevated. Pollak writes about the opportunity in a blog post that features tips from dealer Brian Benstock of Paragon Honda, Woodside, NY, to help other dealers do a better job of sourcing inventory directly from customers.

Pollak also cautions that as dealers adapt and adjust to today’s multi-channel used vehicle sourcing environment, they’ll need to ensure that they take advantage of technology and tools to measure and manage the outcomes of every vehicle acquired in each sourcing channel.

“You can’t measure your used vehicle sourcing efforts without metrics,” Pollak says. “And if you don’t measure, you can’t manage and if you can’t manage, you can’t improve your performance.”