Q1 2025 New Car Insights

Read what we learned during Q1 below:

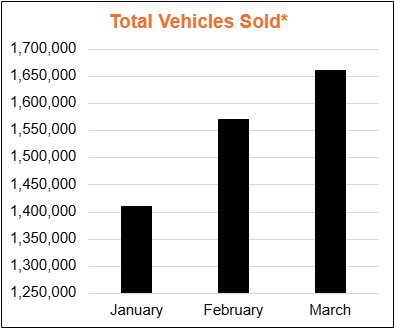

Insight: New-vehicle sales surged in March, driven by strong seasonal trends and the urgency created by the import tariff announcement. The quarter showed gradual growth in the pace of retail sales increasing almost every week through February and March.

Looking ahead to Q2: Maintaining inventory levels will be more difficult for some dealers than others, given decisions by some OEMs to delay vehicle production or shipments amid uncertainty over tariff costs. Cox Automotive expects the uncertainty, and broader economic conditions, to slow the pace of new vehicle sales in the months ahead.

Insight: The average transaction price (ATP) of a new vehicle was $47,462 in March, down 0.2% month over month and up 0.3% year over year. In March, new-vehicle sales incentives were 7.0%, or $3,339, virtually flat month over month.

Looking ahead to Q2: The implementation of tariffs will significantly increase the costs of imported new vehicles. As pre-tariff inventory is depleted, automakers may distribute these additional costs across their entire portfolio of vehicles. Cox Automotive estimates tariffs could add as much as $5,000 in additional costs to new vehicles, depending on how OEMs account for the added expense.

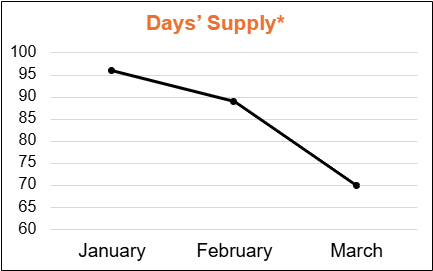

Insight: The new-vehicle days’ supply was 70 at the beginning of April, down 21 days from the upwardly revised 91 days at the beginning of March. To start April, days’ supply was down 10 days compared to last year, returning inventory to levels last seen in 2023.

Insight: Holding costs closed the quarter at $7.90/day, up about 14 percent from the average across the fourth quarter of 2024. The increase reflects the reality of still-high floorplan interest rates and related holding costs.

Action: Work to retail slow-moving units faster to diminish the drag floorplan/holding cost expense causes for new vehicle profitability.

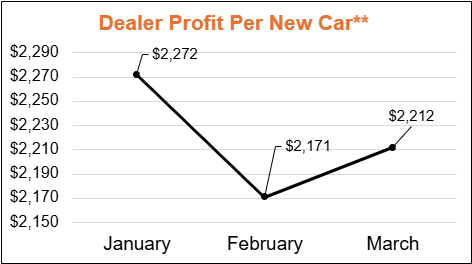

Insight: New vehicle profitability—front-end gross plus F&I—averaged about $2,200 in March, down 8 percent from March 2024, but up slightly from the average in February.

Looking ahead to Q2: New vehicle profitability could be challenged in the coming months if retail demand softens due to affordability and OEMs dial back incentives to optimize their profitability. New vehicle floorplan expense remains a risk given current rates—a reminders that dealers will fare best as they balance their new vehicle days supply to the market, and turn and earn in segments where profit risk is highest.

Q1 2025 Used Car Insights

Read what we learned during Q1 below:

Insight: Thanks to a first quarter that closed with a pre-tariff sales surge, used-vehicle inventory levels at dealerships started April lower than the prior two months, and lower than April 2024.

Retail used vehicle sales reached 1.66 million vehicles in March, up 9% compared to the 1.52 million reported in February. March is typically the strongest month of the year for used-vehicle retail sales, and between tax refunds and tariff talks, this year was the strongest we have seen since 2021 and up 12% compared to last year.

Insight: Thanks to pre-tariff sales, dealers started April with a used vehicle days’ supply of 39 days, down four days from the beginning of March, and down five days compared to a year ago. Days’ supply is the tightest since 2021 for this time of year and remains down nearly two days compared to 2019 levels.

Action: Be mindful of how and where you acquire inventory. Auction sales and values have increased as dealers look to replenish their lots. Look beyond trade-ins—to your service drive and other channels—to acquire vehicles directly from customers. Know that demand, and prices, are highest for lower-cost vehicles.

Insight: March saw the first month-over-month increase in used retail prices this year. The average used-vehicle listing price was $25,180, up from the revised $25,011 at the start of March and now down 1% from a year earlier.

Action: Keep a close eye on the retail price positioning of your vehicles in their competitive sets, and be careful about increasing retail prices, given inventory scarcity and demand, beyond what your local market will bear.

Insight: The average used vehicle trade-in equity increased in March. Historically, March has been a strong month for the used car market.

Want more insights?

Dale Pollak: Like I See It

Read Dale Pollak’s take on what’s happening in the industry.

vAuto Podcast

Listen to hear perspectives from dealers and vAuto leaders.

Learn how we can partner with your dealership

"*" indicates required fields