Q4 2025 New Car Insights

Read what we learned during Q4 below:

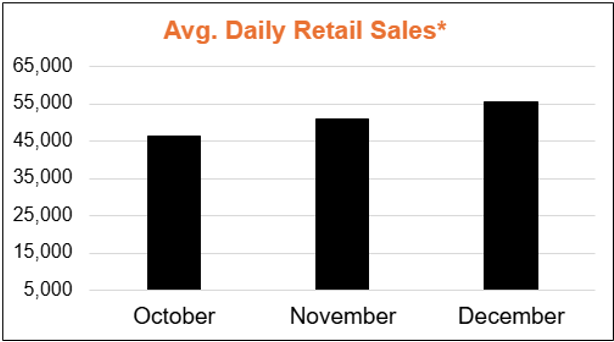

1) 3-Month Sales Trend (Avg. Daily Retail Sales)

Insight: Retail sales accelerated steadily through Q4, culminating in a strong December. This likely reflects seasonal year-end pull-forward, richer OEM incentives, and improved inventory availability. Momentum should be treated as partially seasonal, but it also signals that the market will reward the right price/merchandising mix going into 2026 if inventory is aligned with high-turn trims.

Action:

- Front-load 2026 campaigns: Retarget those 2025 shoppers who didn’t convert; push “In‑Transit” and recently arrived VINs in paid search/shopping ads.

- Tighten price-to-market on high‑demand vehicles: Competitively price to maintain velocity.

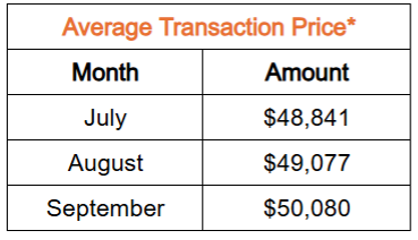

2) Average Transaction Price (ATP)

Insight: ATPs rose despite heavier year‑end selling (+$1,183 over Q4) suggesting decent consumer willingness to pay and mix shifting up (larger trims/tech packages). However, the simultaneous decline in gross per unit indicates ATP increases were likely offset by higher incentives, higher acquisition costs, or heavier discounting to hit stair‑steps.

Action:

- Protect front-end gross with mix discipline: Favor trims and packages that carry better contribution margin and finance accessory bundles (wheels, protection, connected services).

- Price laddering: Present a good/better/best structure online with transparent step‑ups; anchor with a well-equipped mid-trim to raise realized ATP without over‑discounting.

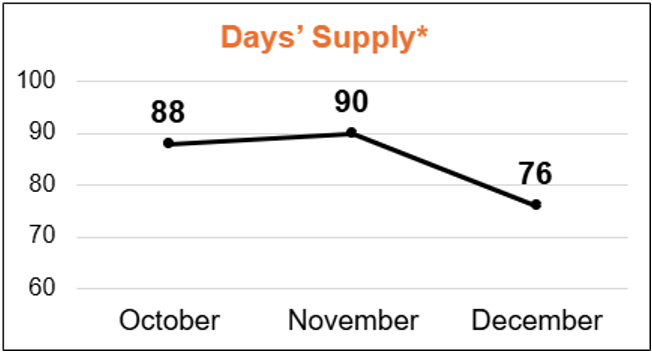

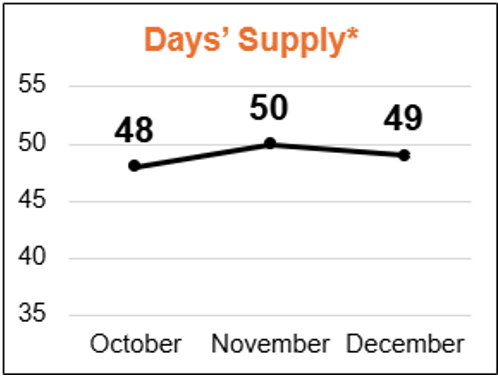

3) Days’ Supply

Insight: Supply tightened in December while sales accelerated—a positive backdrop for turn and floorplan costs. A sustained target near 45–60 days’ supply typically maximizes turn without starving selection.

Action:

- Prioritize fast‑turn colors and must‑have packages.

- Aging policy discipline: Enforce a 30/60/90‑day pricing ladder.

- In‑Transit merchandising: List inbound units with ETA windows and digital retailing hooks to convert early interest into deposits.

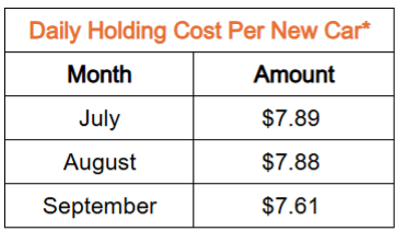

4) Daily Holding Cost per New Car

Insight: Lower days’ supply is directly reducing carrying cost. Every extra day you shave off average age drops floorplan cost and minimizes your risk of losing profits.

Action:

- Turn-time KPIs: Track time to frontline with a <48‑hour goal.

- Photo & listing quality checklist: 30+ photos, 360s where possible, feature callouts, and payment‑first VDPs to improve SRP, VDP, lead conversion.

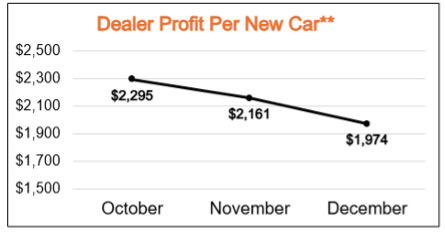

5) Dealer Profit per New Car

Insight: Despite stronger demand and lower holding cost, front‑end gross per unit fell (down $321 across Q4). This is consistent with year‑end programs, higher OEM targets, and aggressive discounting to unlock stair‑step money. The fix isn’t pure price lifting; it’s mix management, aligned incentives, and F&I penetration.

Action:

- Order and allocate toward trims with higher contribution margins.

- Implement a Price to Market strategy by segment

Q4 2025 Used Car Insights

Read what we learned during Q4 below:

1) Total Vehicles Sold

Insight: The used market remained remarkably stable throughout Q4, showing no major swings in consumer demand. This indicates a mature, steady environment where macro‑conditions (rates, affordability, supply) are keeping volume predictable. Dealers shouldn’t expect meaningful seasonal boosts or slumps as consumers are buying consistently month to month, with no signs of demand overheating or collapsing.

Action:

- Plan inventory around stability, not growth. With demand flat, your advantage comes from better merchandising and speed, not oversizing inventory.

- Lean into conversion optimization:

- Refresh photos + descriptions every 14 days

- Add new price/payment hooks on stale units

- Push “as‑is”, older, and high‑mile units to wholesale before they drag down turn

2) Days’ Supply

Insight: Used supply sits in a very healthy band nationally, balancing availability and turn efficiency. The slight uptick in November was negligible and reversed in December, confirming that sourcing conditions are steady and that vehicles aren’t piling up on lots. This environment favors disciplined inventory management and benefits stores that maintain strong velocity practices, as the market is moving neither too fast nor too slow.

Action:

- Target a 35–45 day supply at the store level. The national market is healthy, but dealers who run tighter reduce reconditioning lag and floorplan risk.

- Tighten your aging policy:

- 0–20 days: No discounts; focus on merchandising

- 21–45 days: Light pricing adjustments & renewed marketing

- 45–60 days: Aggressive pricing changes and evaluate exit

- 60+ days: Wholesale unless uniquely desirable

- Accelerate recon-to-frontline time. Every 24 hours saved = stronger margin.

3) Average Listing Price

Insight: Listing prices stayed stable across Q4, with a minor dip in November followed by recovery in December. The tight range suggests pricing is not being influenced by major external cost drivers (like sudden wholesale price spikes). Instead, the market is maintaining a balance between customer affordability challenges and dealer cost pressures.

Action:

- Price to market daily, especially sub‑$25K units. This price band is most competitive and most shopped.

- Promote payment-first merchandising: Most shoppers in this price range sort by affordability. Lead with:

- Payment range

- Down-payment scenarios

4) Average Trade-In Equity

Insight: Customer trade‑in equity trended downward from October and remained below earlier highs, indicating that the rapid depreciation seen over the past year is normalizing equity positions but not reversing them. Consumers still bring meaningful equity, but not at the elevated levels seen during 2021–2023 when used values spiked.

Action:

- Expect customers to have less money to bridge gaps. Negative equity risk remains low, but not improving.

- Acquire aggressively from service drive: These cars are cheaper to recondition and more likely to match your ideal inventory buckets.

Sources:

* Cox Automotive Insights

** J.D. Power

Need to catch up? View our archived insights here.

Interested in a Demo?

Fill out this form to request a personalized demo of any or our solutions.

"*" indicates required fields